AXS PAYMENTS

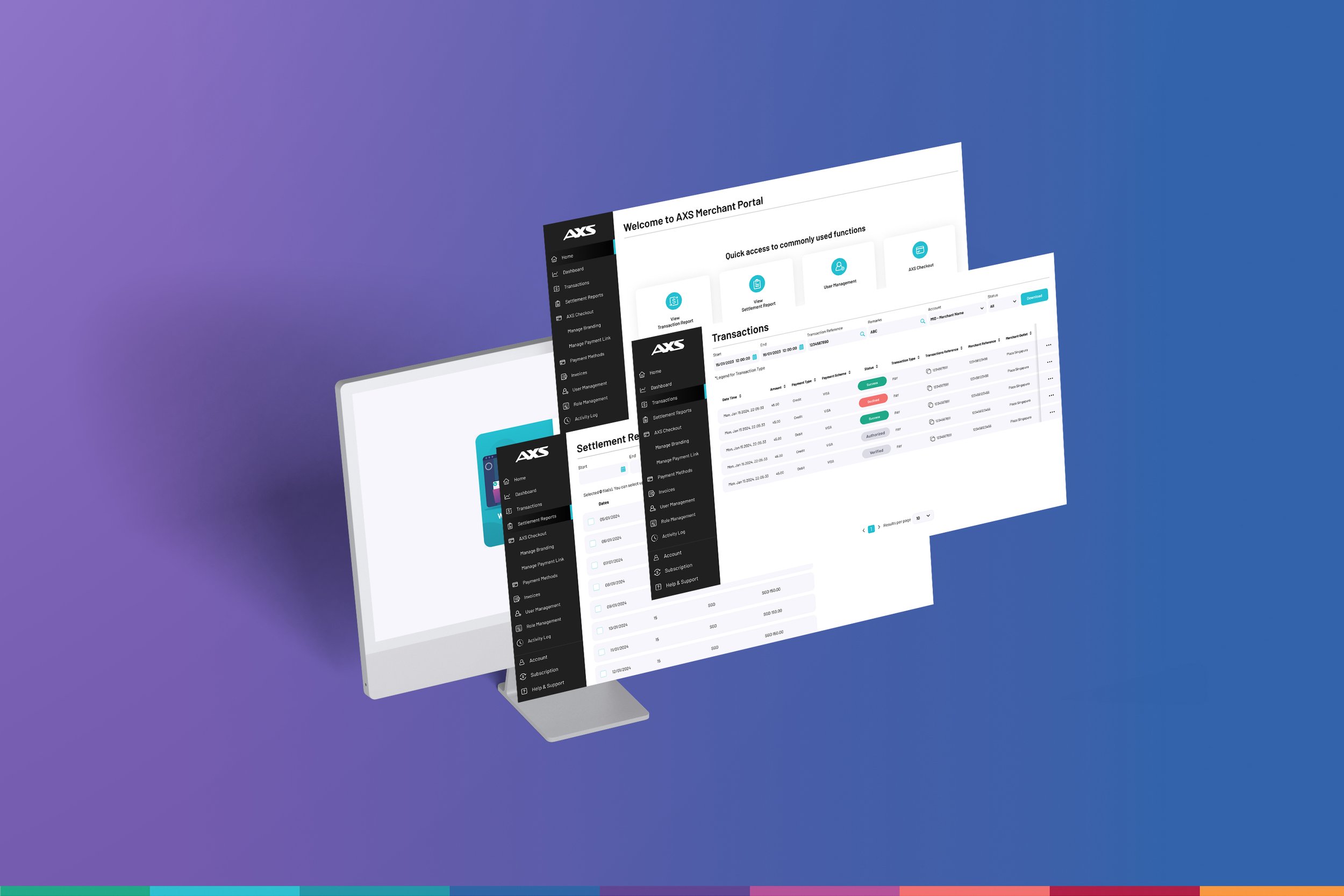

MERCHANT PORTAL

Redesigning the AXS Merchant Experience

CLIENT: AXS Pte Ltd

ROLES: UI Design, UX Research

DURATION: 1 month

INFO

As part of my UX Design capstone at General Assembly, I collaborated with two teammates to tackle a real-world design brief from AXS, Singapore’s leading payment solutions provider.

DESIGN BRIEF

AXS sought to improve the Merchant Portal experience to better support merchants in managing backend operations such as payments, refunds, and reporting. While the platform is trusted for its credibility and reliability, fragmented workflows and usability gaps were creating friction in merchants’ day-to-day operations.

ABOUT AXS MERCHANT PORTAL

The AXS Merchant Portal supports merchants in managing payments across AXS channels by providing tools for reconciliation, refunds, and reporting — ensuring visibility and accuracy in their financial operations. Merchants rely on AXS not only to process transaction volumes, but also to maintain alignment between payment records, accounting needs, and day-to-day business operations.

These activities are often carried out daily or weekly under time pressure, alongside responsibilities such as inventory management and customer service. As transaction volumes increase, the need for clear information, efficient workflows, and reliable data becomes increasingly critical.

While AXS is trusted for its credibility and payment reliability, the portal plays a role beyond transaction processing, supporting merchants as a reliable operational tool for managing complexity, scaling confidently, and running their businesses efficiently.

RESULTS AND IMPACT

After iteration, the portal achieved an overall 60% improvement in task efficiency, supported by smoother navigation and more intuitive workflows. New pages including payment methods and integrations, were also positively received for clarity and ease of use.

To understand where friction occurred and how the portal could better support merchants at scale, we began by breaking down the problem through research and collaborative exploration.

DESIGN AND RESEARCH PROCESS

Problem Discovery

Analysed competitors, reviewed existing features, and tested with users to reveal gaps and pain points.

Define

Synthesise research insights and user needs. Create problem statement & “How Might We” statements to frame opportunities.

Prototype

Ideate and create prototype based on research outcomes and user testing/interview.

Ideate

Leveraged cross-functional perspectives from AXS to reveal gaps and opportunities in the customer journey.

Iterate

Built on design workshop learnings to collaboratively shape ideas.

Deliver

Presented final ideas to AXS leaders and C-suite.

CHALLENGES

Before proposing solutions, we needed to clearly define the challenges merchants faced when managing day-to-day operations within the portal.

Although merchants rely on AXS for its credibility and payment reliability, the Merchant Portal experience did not fully support their day-to-day operational needs. Key functions required for daily operations were often buried deep within the portal or constrained by rigid flows, introducing friction in routine tasks such as reconciliation, refunds, and reporting.

As transaction volume increased, these inefficiencies became more pronounced. Merchants spent increased time locating information, validating reports, and resolving discrepancies, which slowed operations and reduced confidence in the platform’s usability. The challenge was to identify where friction occurred within these workflows and surface critical functions more intuitively, while balancing merchant usability needs with AXS’s business and operational requirements.

SOLUTION

To address friction caused by buried functions and rigid workflows, we redesigned the portal experience to improve the discoverability and flow of critical operational features. Key workflows such as reconciliation, refunds, and reporting were restructured to better align merchant tasks with underlying business logic and system requirements.

The solution improves everyday workflows without compromising business requirements or compliance. This allows merchants to manage growing transaction volumes more efficiently and reinforces confidence in the platform’s usability.

RESEARCH OBJECTIVES & APPROACH

To understand how these issues surfaced in real workflows, we conducted qualitative research with merchants across different business types.

We interviewed 10 merchants across retail, F&B, and B2B to capture a diverse range of operational workflows and business needs. This sample size was sufficient to surface recurring patterns and shared pain points while allowing for in-depth qualitative exploration.

By including both AXS and non-AXS merchants, we were able to compare existing AXS workflows with alternative solutions merchants were already using. This helped identify usability gaps, unmet expectations, and opportunities for improvement relative to industry standards.

The interviews focused on understanding how merchants manage day-to-day tasks such as reconciliation, refunds, and reporting, where friction commonly occurs, and what features or functions merchants felt would better support their workflows and improve efficiency.

Insights from interviews were brought into a collaborative workshop to synthesise findings, align perspectives, and explore solution directions with the broader team.

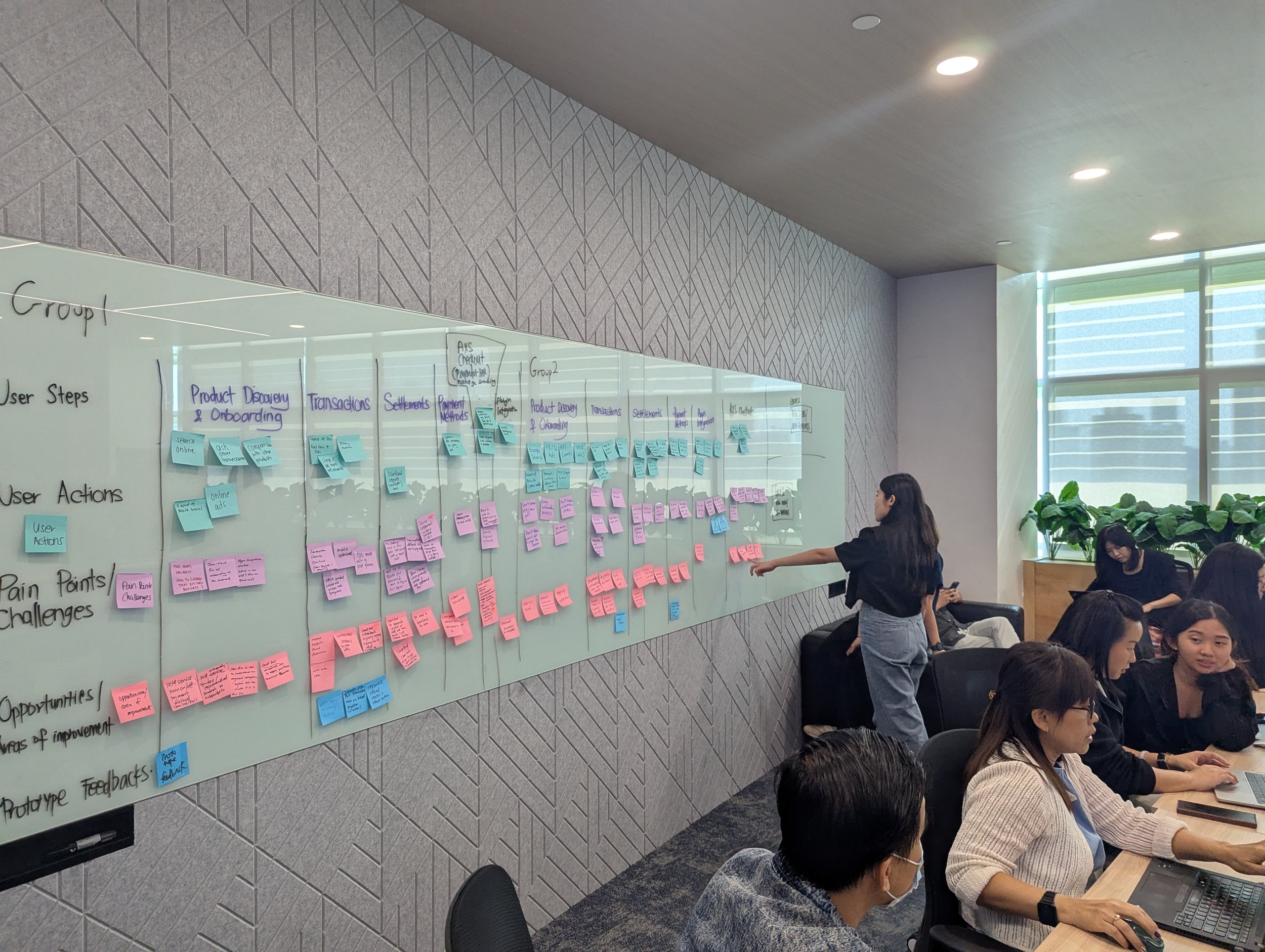

To better understand how merchants interact with AXS across their journey, I facilitate collaborative workshop with stakeholders from Product, Sales, Engineering, Marketing and more. Together, we mapped the end-to-end merchant experience — from onboarding to checkout — to uncover where friction occurs and where new value could be created. This exercise revealed key gaps in transparency and efficiency within the current portal and helped shape a clearer direction for AXS’s next-generation product and UX strategy.

PRODUCT STRATEGY AND USER EXPERIENCE DESIGN WORKSHOP

GROUP DISCUSSION Hands-on session where mixed teams collaborated using post-its to map ideas, build alignment, and surface key pain points.

SHARING Teams exchanged insights and feedback, uncovering new perspectives through open discussion and cross-team understanding.

COLLABORATIVE FEATURE EVALUATION Guided the group to evaluate each feature’s feasibility and impact.

COMMON PAIN POINTS

Through interviews and workshops, we identified recurring pain points across merchant workflows that directly impacted efficiency and trust.

Efficiency gaps Merchants rely on the portal to close their books accurately and on time. Reconciliation, refunds, and reporting are often tied to accounting deadlines, customer disputes, and cash flow management. When reports are limited or unclear, merchants are forced to manually cross-check transactions across systems, increasing the risk of errors and delays.

A cumbersome refund process also directly affects customer satisfaction — slow or confusing refunds create support overhead and damage trust with end customers. As transaction volumes grow, inefficiencies compound, turning routine operational tasks into time-consuming bottlenecks.

Need for integrations

Most merchants operate with many tools — accounting software, CRM platforms, or internal spreadsheets. Without seamless integration, merchants must manually export and re-enter data, which is both error-prone and inefficient.

Seamless connections allow payment data to flow naturally into existing workflows, reducing manual work and ensuring consistency across systems. For merchants, integrations come across as convenient and an operational continuity, especially as their business scales.

Strategic features

Beyond day-to-day operations, merchants look to payment platforms for insights that support decision-making and growth. Higher-level dashboards help merchants monitor performance trends, identify peak periods, and understand customer behaviour at a glance.

Loyalty programs and advanced analytics are seen as strategic tools that enable merchants to move beyond processing transactions toward building longer-term customer relationships and optimising their business performance.

Trust vs. Experience gap

Merchants choose AXS primarily for its credibility, reliability, and established presence. However, when the portal experience feels unintuitive or inefficient, it creates friction between trust in the brand and confidence in daily use.

Over time, usability issues can erode perceived reliability — not of the payment system itself, but of the tools merchants depend on to run their business. Closing this gap is critical to ensuring that trust in AXS extends beyond reputation and into everyday operational experience.

While these pain points surfaced across different merchant types and business sizes, common patterns began to emerge. Merchants struggled with isolated features and fragmented workflows made routine tasks harder as their businesses scaled.

These insights helped us narrow our focus to address issues limiting efficiency, confidence, and growth within the Merchant Portal.

These pain points were synthesised to identify the core problems limiting efficiency and confidence within the portal. The workshop not only generated ideas and strategies, but also deepened our understanding of recurring user pain points. Merchants lack an integrated, end-to-end system that connects key operations such as ordering, payments, refunds, loyalty, and accounting, which makes it difficult to run efficiently and scale. Combined with our research , these insights were synthesised into two guiding problem statements.

How might we enable merchants to simplify backend operations and reduce manual effort?

How might we equip merchants with tools and insights that help them grow their business?

PROBLEM IDENTIFICATION

With users' pain point through research and sharings from the workshop in mind, we translated our insights into high-fidelity prototypes. Each solution was designed to reduce friction, aid merchant to run their business efficiently and aim to allow the whole portal experience to feel effortless, intuitive, and reliable.

PROTOTYPE WALKTHROUGH

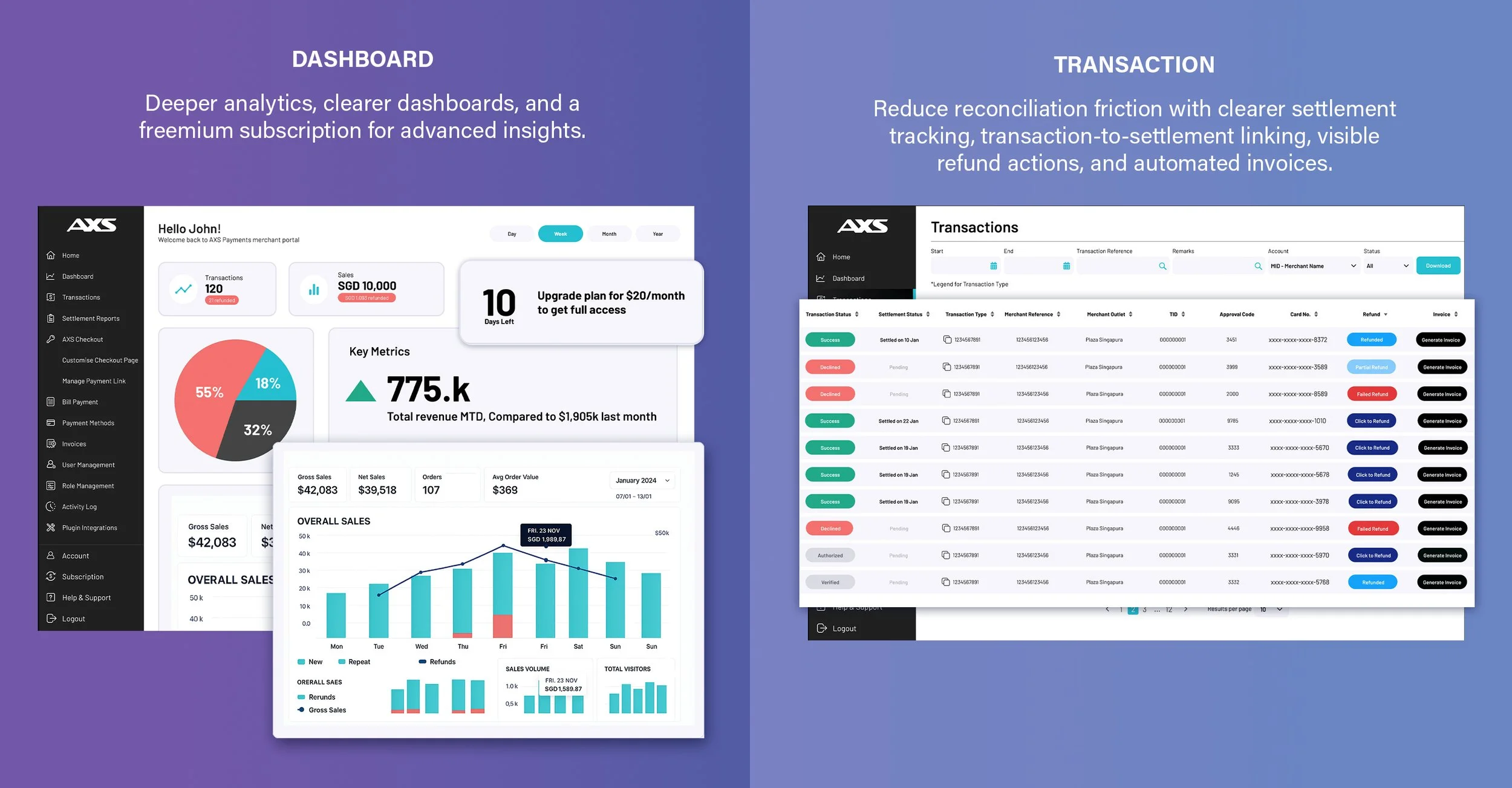

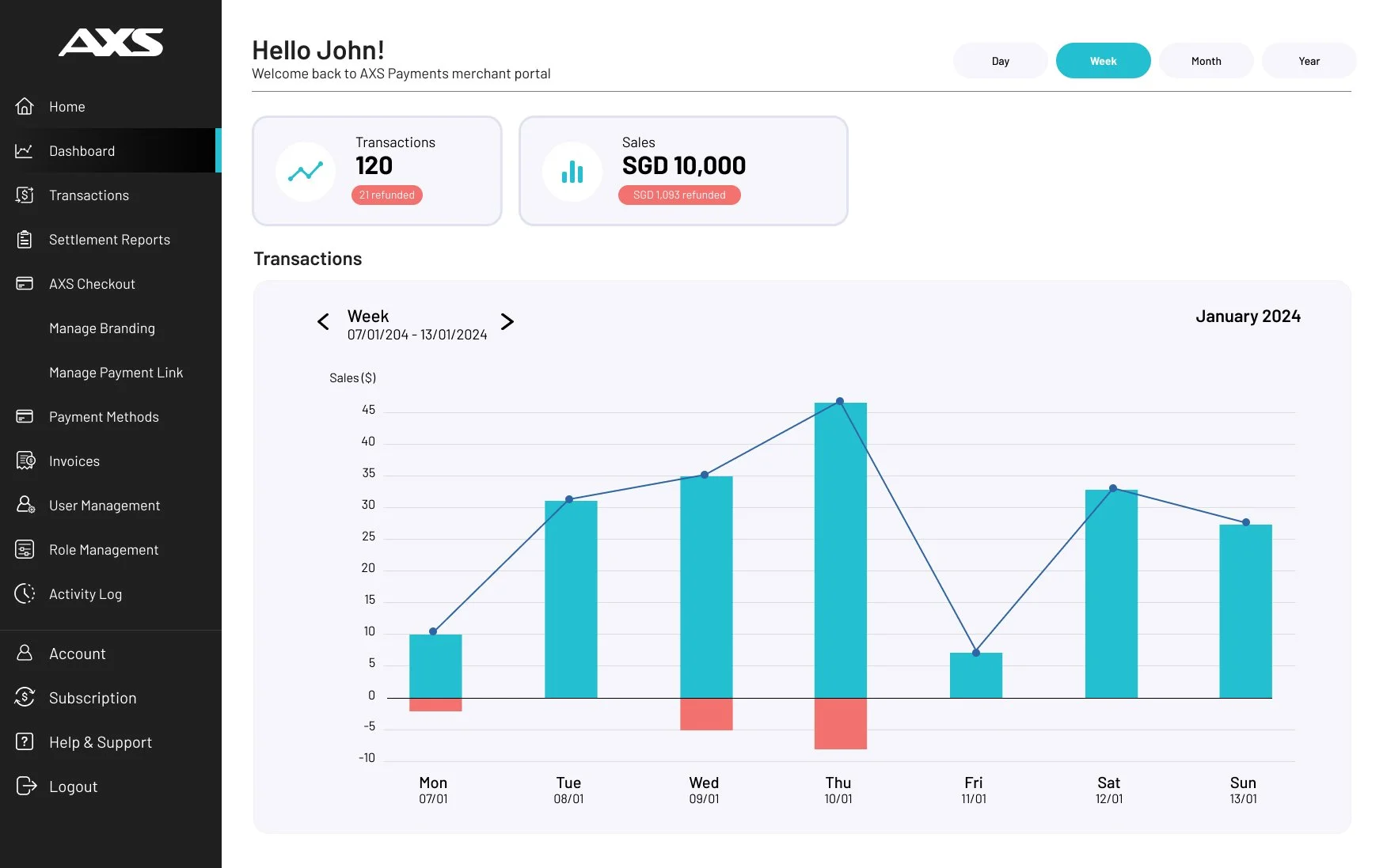

Merchants rely on the AXS dashboard as a central touchpoint to monitor sales performance, track payment and settlement status, and quickly identify issues that require follow-up.

DASHBOARD

BEFORE

• Merchants lacked a consolidated view of settlements and refunds, requiring them to cross-check multiple sections.

• Sales data and fees were not clearly summarised, increasing manual effort during reconciliation.

• Half of the merchants want an at-a-glance view of money in, pending and cash-out status.

AFTER

• A unified dashboard surfaces key metrics such as gross/net sales, refunds, and average order value at a glance.

• Clear visual hierarchy and legends help merchants quickly assess performance without switching contexts.

• Introduce a subscription tier for advanced insights after a free period as a potential business strategy.

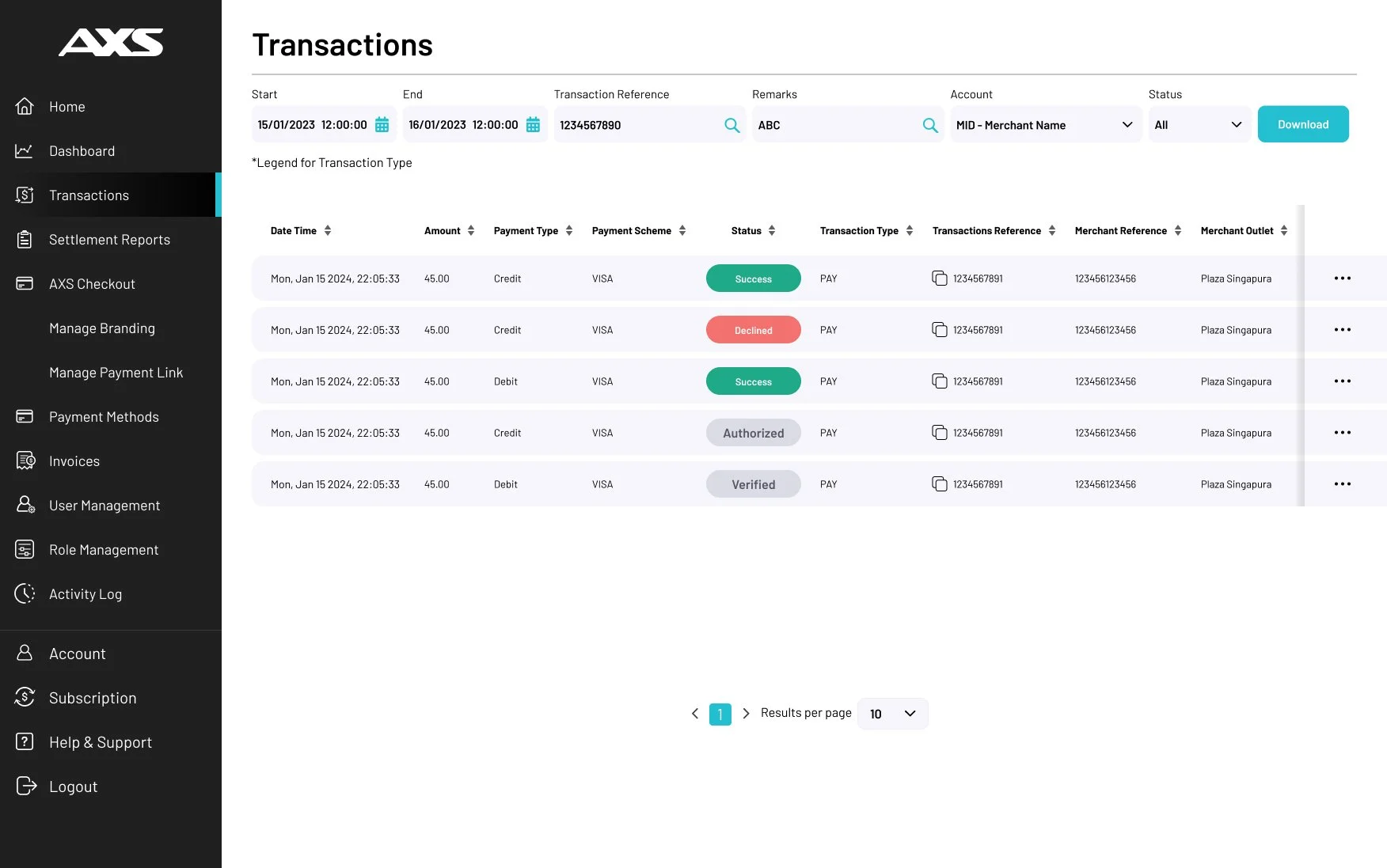

Merchants rely on the Transactions page to verify individual payments, investigate discrepancies, and support reconciliation workflows.

TRANSACTION

BEFORE

• 90% of merchants cited that reconciliation are a “painful” process

• Merchants struggled to locate the refund button, which was buried across three pages.

• Merchants depended on receipts to confirm transactions and maintain records.

AFTER

• Enhance visibility of settlement status.

• Link transactions and settlements to simplify reconciliation.

• Rearrange refund button for visibility.

• Auto invoice generation.

• Time taken reduced by half for refund task.

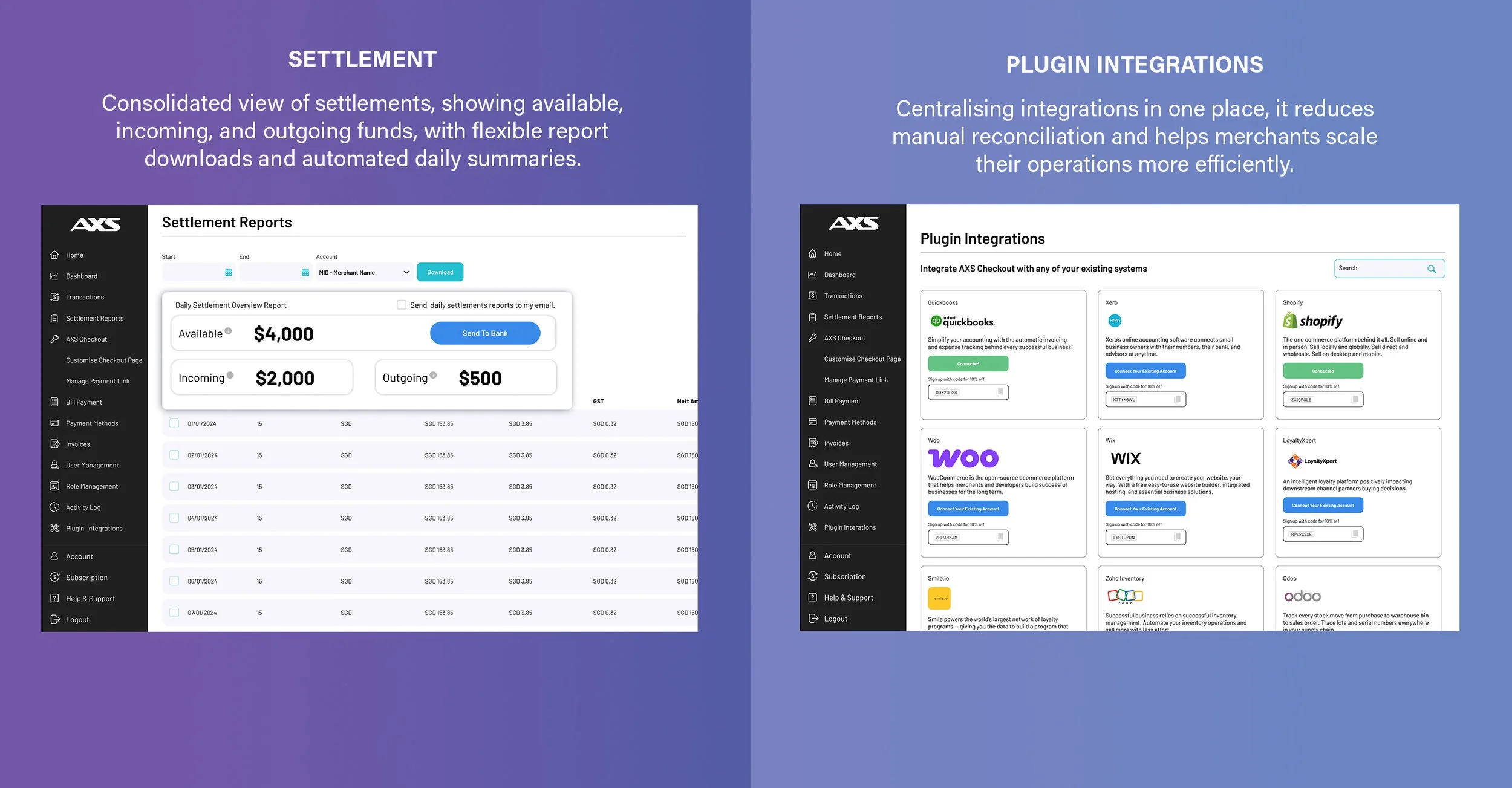

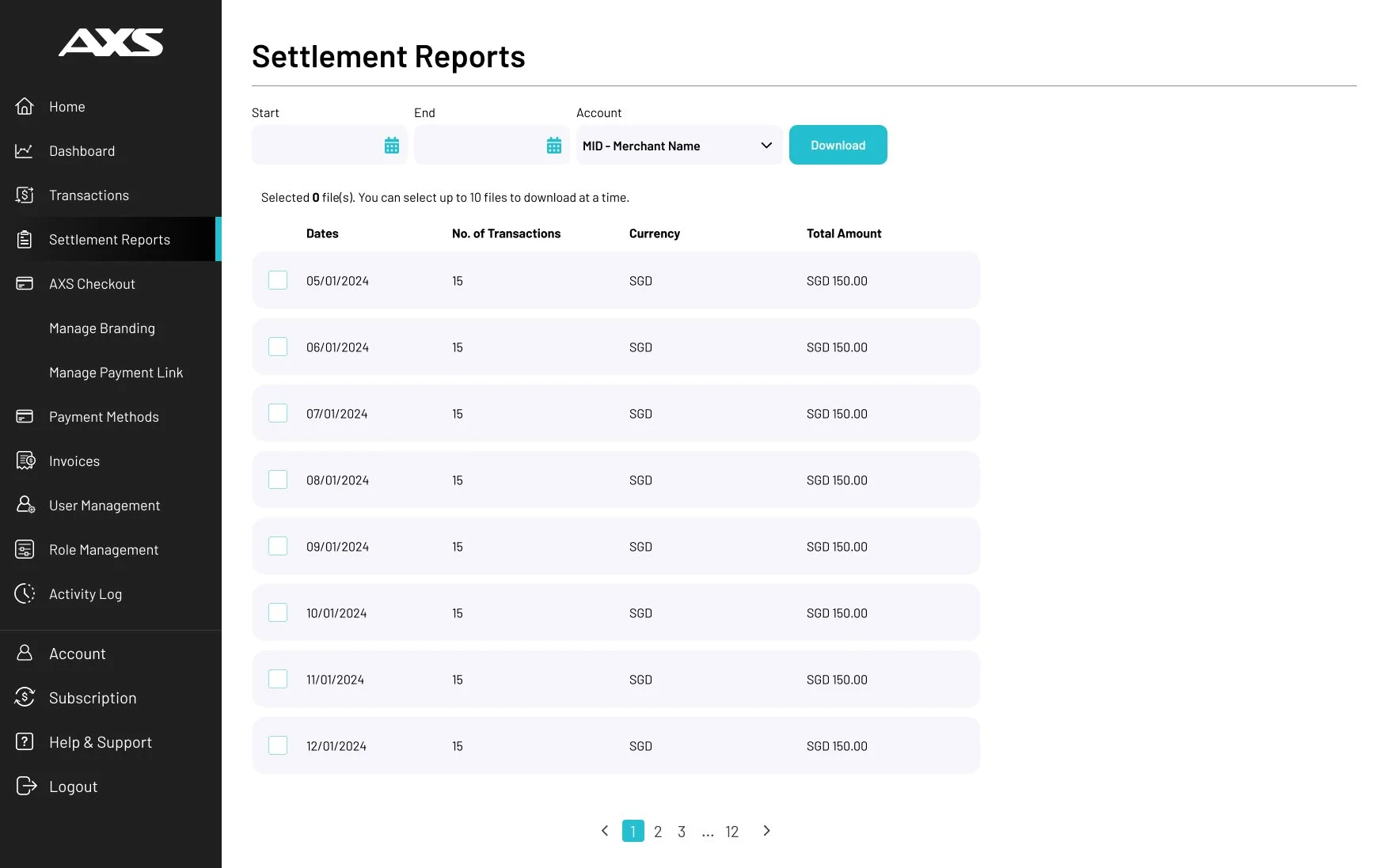

This page plays a critical role in cash flow management and accounting accuracy, helping merchants confirm that what they earned aligns with what they receive.

SETTLEMENT

BEFORE

• Report downloads and reconciliation are tedious, limited to 10 reports within a 24-hour window.

• Merchants want a quick high-level view of incoming funds.

AFTER

• Remove 24-hour download limit; allow bulk report downloads.

• Provide available, incoming and outgoing fund overview.

• Auto generated report for the day sent to email.

PLUGIN INTEGRATION PAGE (Proposed New Page)

Merchants use the Plugin Integration page to connect AXS payments with their existing e-commerce and operational platforms. This helps maintain data consistency, reduce manual work, and scale their payment setup as their business grows.

INSIGHTS • Disconnected systems require merchants to reconcile data manually, leading to inefficiency and scalability issues.

• Reconciling payments remains a key pain point.

ITERATED • Integrate existing accounts with softwares that merchants use.

• Call to action to sign up for software, calls for B2B partnerships.

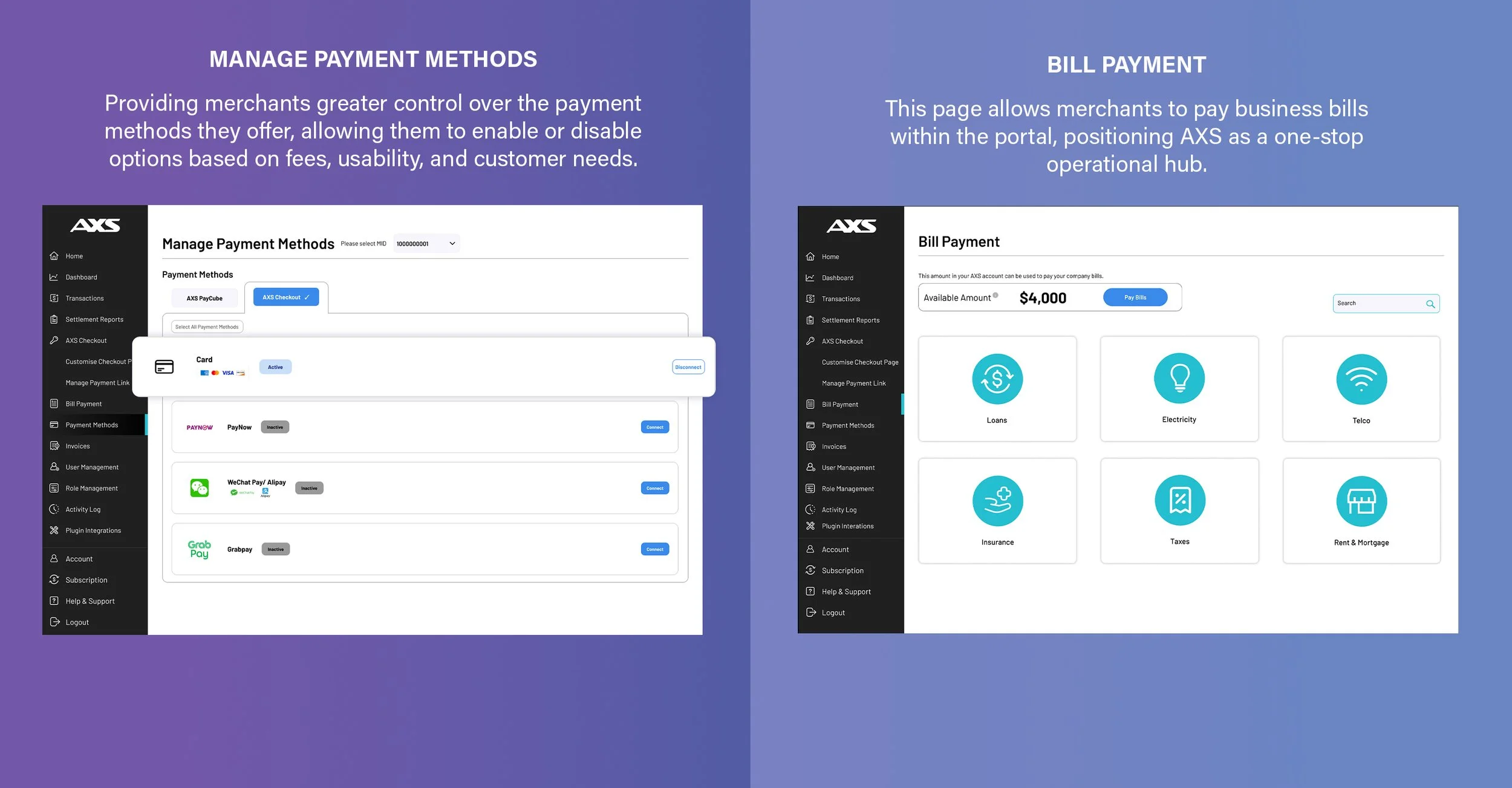

PAYMENT METHODS PAGE (Proposed New Page)

The page allows merchants to enable, configure, and monitor supported payment options across their sales channels, ensuring the right methods are available to customers.

INSIGHTS • Merchants want flexibility to choose payment methods based on fees, usability, and customer needs.

• With more payment methods available, customers especially tourists now look for a wider range of options.

AFTER • Merchant have control over types of payment methods available online vs offline channels.

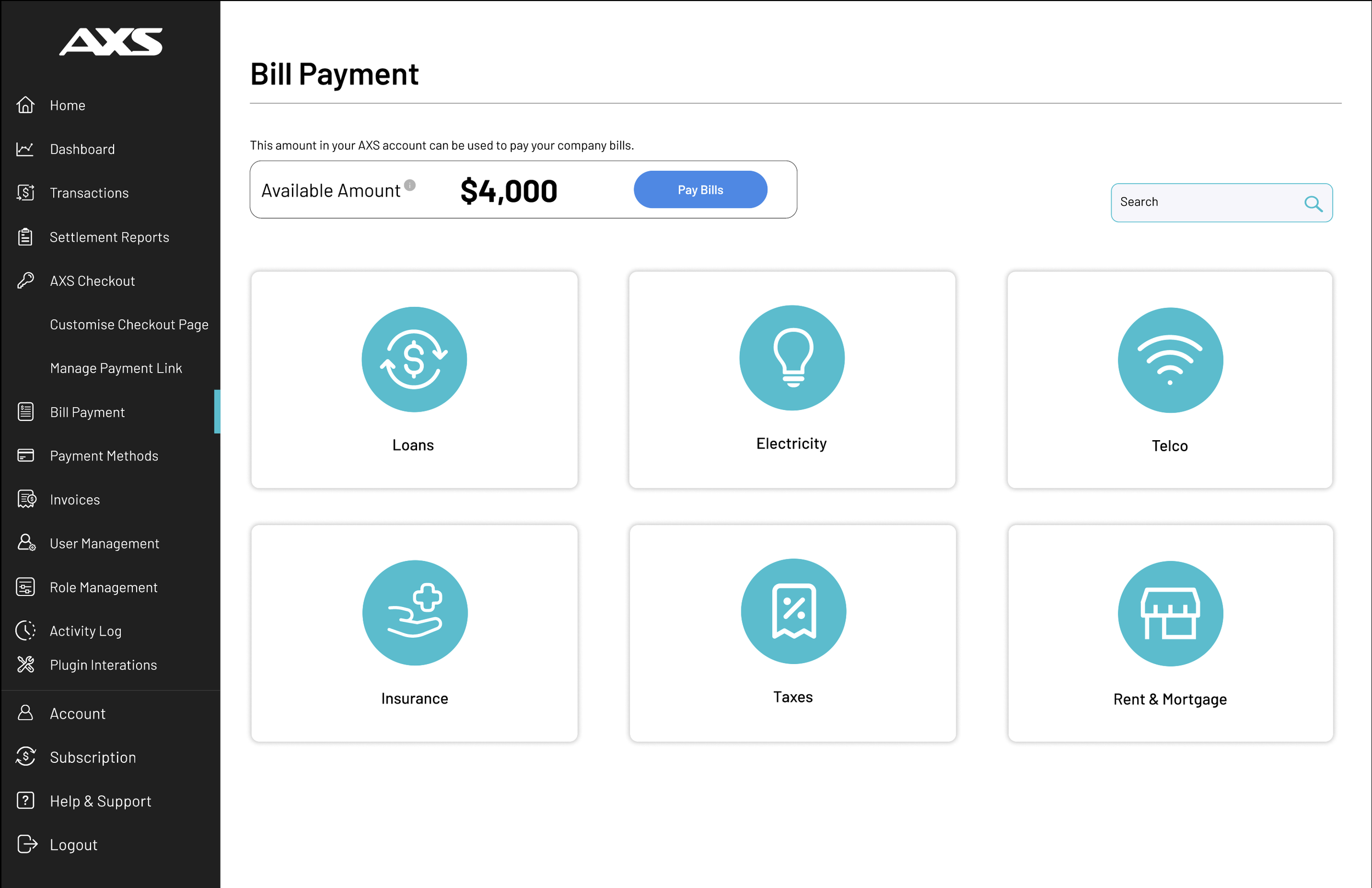

BILL PAYMENT PAGE (Proposed New Page)

The page provides visibility into payment status, amounts, and settlement outcomes, enabling merchants to verify successful bill transactions and resolve discrepancies efficiently.'

• Enable merchants to pay bills directly in the portal to streamline operations.

• Expanding the portal to include bill management would increase its strategic value, positioning it as a more comprehensive operational hub for merchants.

REFLECTION AND TAKEAWAYS

Beyond the final designs, this project surfaced important lessons about balancing usability, scale, and business constraints in complex merchant systems.

• Shared understanding drives better solutions

Facilitating cross-functional workshops helped align Product, Sales, Engineering, and UX around how merchants actually manage payments, refunds, and reporting on a daily basis. This shared context shifted conversations away from isolated features toward end-to-end workflows, directly informing design decisions around navigation structure, data grouping, and feature prioritisation.

• Designing for trust goes beyond brand credibility

While merchants trusted AXS as a payment provider, usability gaps within the portal weakened confidence during day-to-day operations. This project reinforced that trust is built through transparent data, clear system feedback, and predictable workflows — not just reliability at the transaction level.

• Small frictions have outsized impact at scale

Research revealed that issues such as buried actions, unclear reporting labels, and fragmented workflows may seem minor in isolation but significantly slow merchants down as transaction volumes grow. This reinforced the importance of designing for clarity, discoverability, and efficiency in high-frequency operational tasks.